Last Updated on 17 May, 2023

Situated in London’s heart west end, Soho is a very vibrant place. The place is bordered by Regent Street, Oxford Street, Charing Cross Road, and Chinatown. A Fun-loving, diverse, and 24/7 place that is a must-see for tourists.

Soho is known for its stellar restaurants and amazing nightlife in London. This place has plenty of activities to entertain you day and night. If you’re looking for things to do in Soho, we have brought you some amazing activities to keep you entertained throughout the day.

Where Is Soho?

Soho in London is located in London’s Westend. It is surrounded by Covent Garden, Mayfair, Marylebone and St James’s. Soho is an energetic and vibrant area of London where you can find everything from dining, and nightlife, to shopping.

Streets like Frith, Beak, Old Compton and Dean streets are the very epicentre of activities in Soho from day until night time. For those looking for theatre shows, head to Shaftesbury Avenue, those looking for retail therapy, it’s Carnaby Street and Oxford Street.

If you are looking for food, check out Kingly Court, China Town and the Japanese cuisine making its mark on Soho. This is the place to be, day or night in London!

Must-See Places To Visit In Soho

If you are looking for a night out in London, granted you will most likely end up in this part of town. Whether you want theatres, casinos, nightclubs, 24-hour cinemas, amazing eateries or people-watching, Soho is among those lively places that are to be experienced.

To save money on some of the additional expenses like tours, afternoon tea, cocktail experiences, consider buying tickets in advance via Red Letter Days, Viator or Get Your Guide.

Photographer’s Gallery

You will be amazed to see the gallery-rich London that has a dedicated public venue for photography. This was not present in Soho until 1970. In 1971, Soho got its Photographer’s gallery added to the beauty of this place.

Kissaten

They keep the tradition alive by making quality tea. Do not forget to sip the bubble tea which is an absolute favorite of Visitors here! It has a fruity milky tea base that has chewy tapioca pearls to give the most unique experience possible.

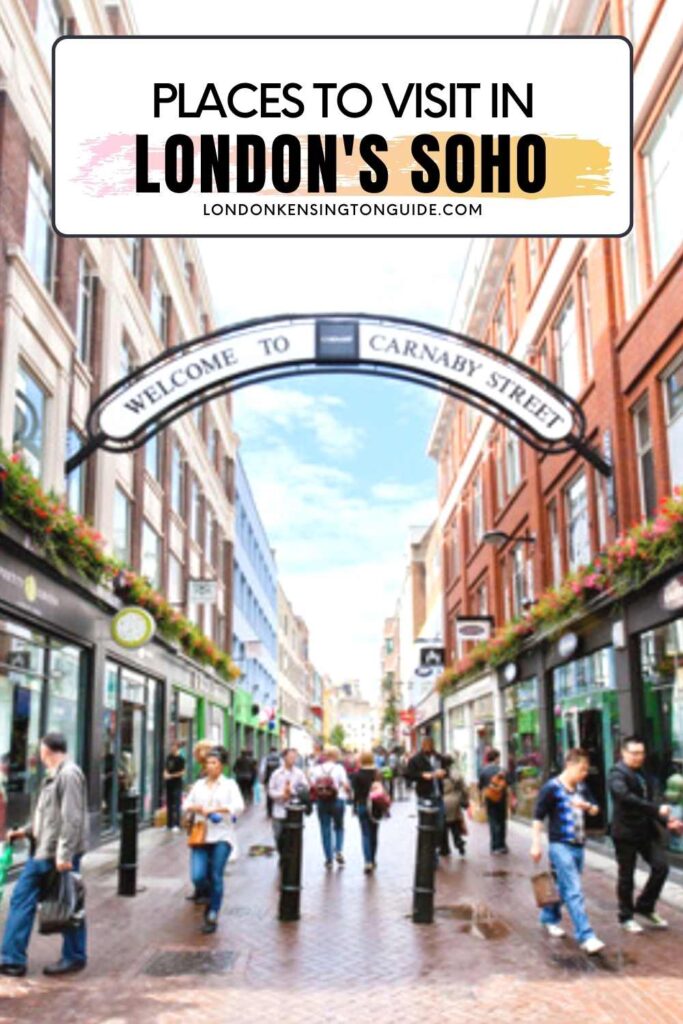

Carnaby Street

Carnaby is a beautiful dining and shopping destination with more than 150 brands, concept stores, boutiques, and flagships. It also has several independent restaurants, cafes, and bars on the world-famous Carnaby Street.

It has an intriguing mix of independent stores and global brands. The stores have everything from new designer names and heritage labels to well-established designers.

Crystal Maze Live Experience

The crystal maze live experience holds an event for a lifetime. It has popular 90s TV shows that hold an immersive experience for you. The concept is very simple and unique.

Scream like there’s no tomorrow, play around like loons, complete exciting challenges and wear amazing bomber jackets. How much more fun does a human require? The crystal maze life experience will be a perfect break from mundane life.

Ronnie Scott’s

Ronnie Scott opened a small basement club in 1959. London’s west end has this amazing place where local musicians can jam. Presently, Ronnie Scott’s is a very popular jazz club in the world, inviting audiences filled with fun to enjoy the musical night.

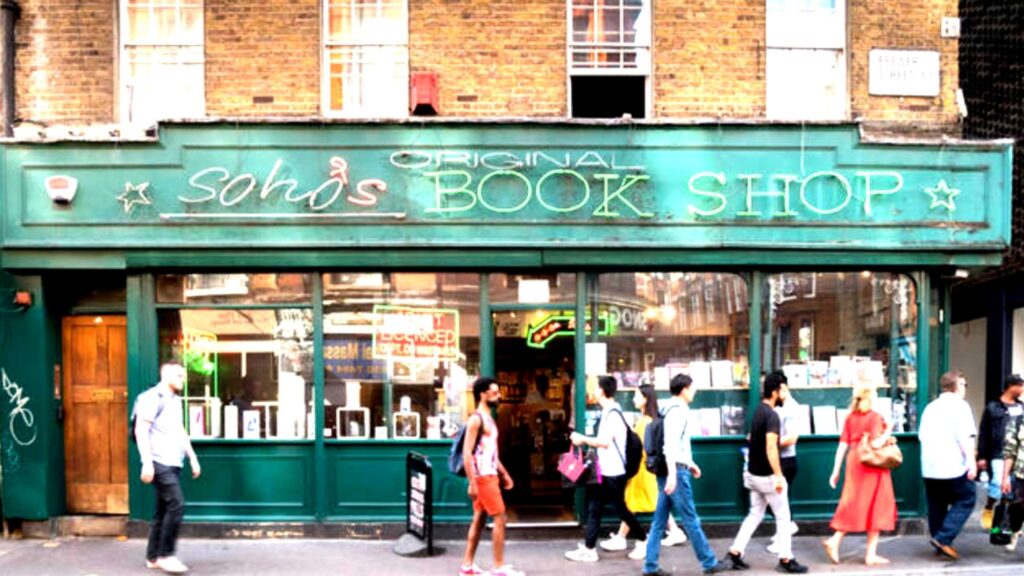

Foyles

For all the bookaholics, here’s your heaven! Foyles is a perfect destination for book lovers in the world. For over 100 years, Foyles has continued to amaze Soho locals and tourists.

You can spend your entire day reading exclusive books. They have cafes for drinks and food requirements. When you visit this place, it looks no less than a dream.

The interior, stationeries, and books are just awe-inspiring. One time, it also held the record for being the biggest bookshop in the world.

Liberty London Department Store

Among London department stores worth checking out. The Tudor-inspired exterior of the Liberty London store is truly a treasure.

Inside it, you will find curated home-wares, fragrances, designer fashions, and beautiful floral prints which have given it the fame it has today.

Hamleys

Not just food and clothing, Soho has the best outlet for the most amazing toys in the world. It is all joy and fun in Hamleys. They have toys to make the kids go crazy.

You can purchase toys from Hamleys to pamper your little ones with the best quality and design. They also have a wide variety of educational toys for the overall development of your child.

Ice Cream Indulgence at Chin Chin Dessert Club

The Chin Chin Dessert Club has the nicest ice cream in London. The ice cream is enjoyable and very fancy which is not like ordinary truck ice cream. The ice cream here is frozen by liquid hydrogen which makes the ice cream very smooth.

They have all the wacky flavors. For example, they have olive oil and coffee ice cream. It doesn’t sound great right? Once you taste it, you will want to have more and more.

Tea and Dim Sum in Yauatcha

Yauatcha came with a bang in 2004 in Soho. It has been a cult favorite of people over there as it is delicious and filling to satiate hunger.

It delights and dazzles visitors with a dim sum menu and 60 exotic types of teas. Their menu has delicately wrapped dumplings with innovative twists. While we are on that topic, be sure to check out these Japanese patisseries.

View this post on Instagram

The Place Where William Blake Was Born

Soho claims that it is the birthplace of William Blake, Britain’s eminent poet. The revered writer was born on Broad Street in 1757, which is now called Broadwick Street. He lived there till 1782, until his marriage.

Notre Dame De France

Just in the middle of the Soho district, there’s the Notre Dame de France which is a French landmark. The Church has London’s more striking sights.

It has a series of murals by French artist, and film director Jean Cocteau. These murals are the attraction of the church.

Have Moments Filled With Fun in Soho Square

The best thing about Soho is that no matter which corner of this place you are in, you will always have a place to relax.

This restaurant gives a vibe of Switzerland. Dim lights, warm wood, and great music and interior effortlessly create a cool and classy atmosphere.

When visiting Soho square, do not miss the lip-smacking cheesy goodness of Raclette over roasted vegetables, pork, and potato.

Try truffle fondue as well. Both the dishes are just delicious! Their cocktails have the perfect blend of sour, sweet, and bitter to refresh you from within.

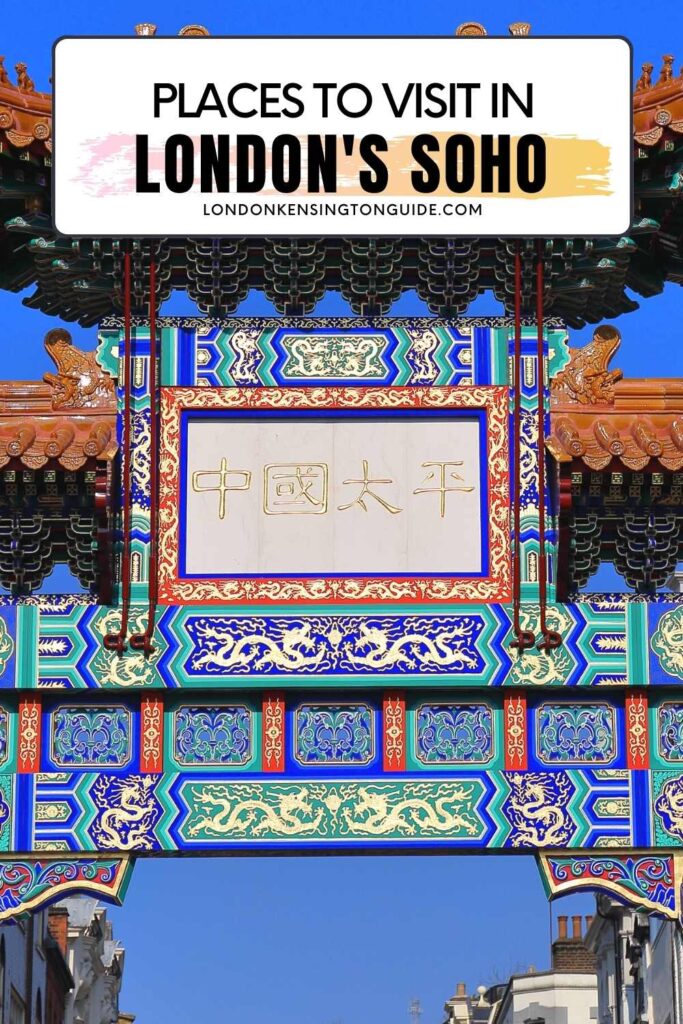

Visit Chinatown

The origin of this place dates back to the arrival of Chinese sailors in the late 19th century. As many of them started small businesses in this area, they left an indelible mark on Soho.

They offer affordable yet delicious meals and one of the best places to grab London’s famous desserts.

Cocktails at a Speakeasy

Cocktails and Soho are the best combinations! They go perfectly great together. Soho is filled with cocktail bars that provide delicious drinks that will never be a problem for you.

From rooftop bars to underground speakeasies, you don’t have to go to any other place.

The most famous ones are The Blind Pig and Swift. They serve brilliant cocktails in the most comfortable setting. If you have enough time, you can head to Disrepute. Make sure you book ahead before going as it is packed on the weekends.

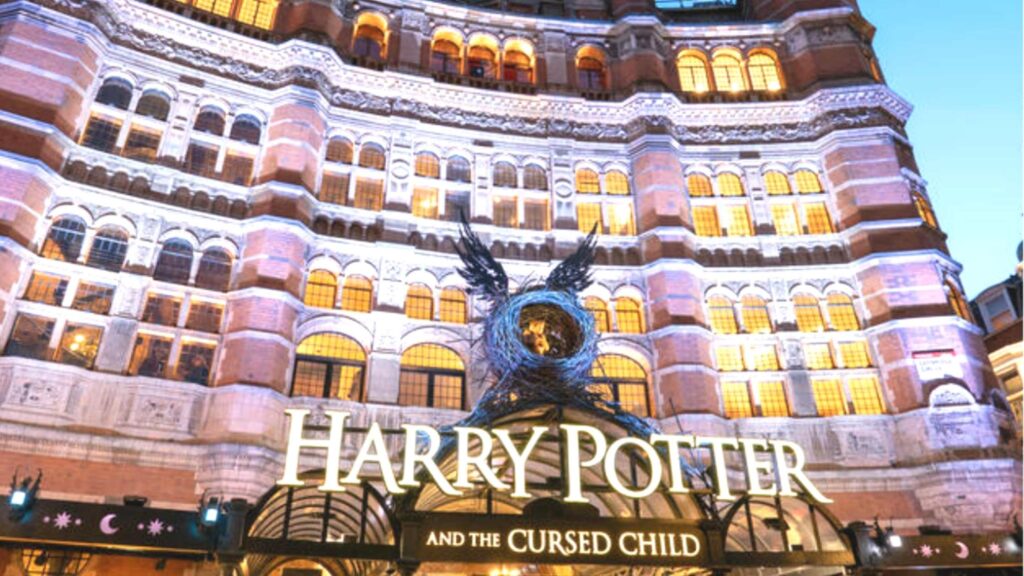

Theatre on Shaftesbury Avenue

This is listed amongst the top things to do in Soho. This place has been all about theatres for centuries and visiting it is undeniable.

Shaftesbury Avenue’s IMHO is the best theatre and station in the world. You will love the variety of choices for shows that are available here. Shaftesbury Avenue has iconic theatres like Apollo theatre, Palace Theatre, and Gielgud.

Explore Japanese Cuisine in Soho

The cafes here have cocktails and Japanese cuisines with a contemporary spin and the best interiors. Oka restaurant is one such restaurant where you will be pleased by their food and service.

Other restaurants are Robata, Inamo Soho, Shoryu Carnaby, Hot Stone, Shoryu, and Shackfuyu.

Kingly Court

If you are looking for food markets or markets in West London then this place should not be missed. This is the perfect place to eat and hang out and even better if visiting with friends and all want to eat something totally different.

Head to Kingly Court, a three-story venue featuring an eclectic array of bars & restaurants. You can all grab food from different vendors and find a seat in the lively courtyard.

Snowflake Soho

Situated in the heart of Soho, Snowflake Soho serves truly luxurious gelato and chat. Its location is more ideal as it is near theatres and offices.

It is great for a treat after lunch or dinner with sleek interiors and white mirrored walls. It gives a refreshing vibe to make you feel happy.

EL&N London (Wardour St)

In this world where everything quickly gets updated on Instagram, Instagrammable pictures cannot be missed out. The EL&N is the most picture-perfect cafe with pink and irresistibly chic perfection.

They are the leading Instagrammable cafe and lifestyle brand. They have taken immense efforts to curate picture-perfect settings for the customers. The founder Alexandra Miller has an experience of over a decade in luxury fashion.

Her passion has made today this cafe that has delicacies that not only look stunning but taste delicious. They have a dedicated team of chefs, baristas, and experts from the industry who work their best to bring delectable food to the table. Do not miss out on this!

View this post on Instagram

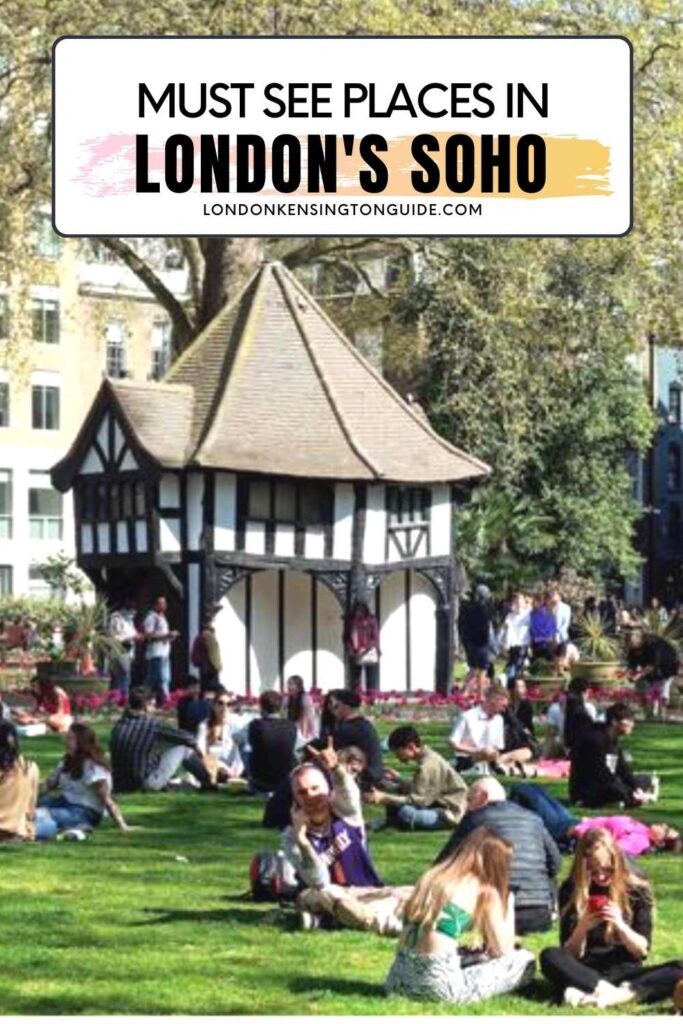

Soho Square Gardens

After all your exploring you can find a spot to sit in this very compact garden with a mock Tudor gazebo. Quiet enough to escape the hustle and bustle of London and busy nightlife in the area.

Not many tourists venture to this Square so you can have a moment of calm before continuing to explore Soho.

Soho Restaurants To Check Out And Places To Eat

Soho Has Traditional And Quirky Restaurants With Extravagant And Down-To-Earth Facilities:

- Soho is famous for the best restaurants and cafes, amongst which Kolamba is loved for Sri Lankan dishes. It took over the site of Gay Hussar which was a Hungarian restaurant. They serve the finest wines and cuisines.

- You can have snacks at a considerable rate at Yalla Yalla. They mostly have Middle Eastern and Lebanese cuisine. Their pastries are amazing.

- The Breakfast Club Soho has a satisfactory brunch on English and American plates.

- The Cinnamon Soho and Masala zone have lip-smacking Indian cuisine.

- Gauthier Soho, Yauatcha, Social Eating House, and Barrafina have extraordinary dining options.

- Honest Burgers has a fix for your burger cravings. They have both plant-based and meat burgers.

The streets of Soho are brimming with dining, shopping, cafes, and nightlife. Other must-visit places nearby are Covent Garden, Mayfair, Piccadilly Circus, and Leicester Square. Soho is famous amongst tourists for its lively vibe.

It is also an important center for the LGBTQ community with many lesbian and gay bars on Old Crompton Streets. It is also a hotbed for music and fashion.

If you want to stay right in the middle of the lively Westend, then check out my guide on places to stay in Soho.

How To Get To Soho | Closest Tube Station To Soho

You can get to Soho via Tottenham Court Road, Piccardilly Circus, Oxford Circus and Leicester Square tube stations. These stations are served by Bakerloo, Centreal, Victoria, Elizabeth, Northern and Piccardily Lines with endless ways to connect via other stations.

You have so many options to get to Soho via train, which also means that getting back home in the evening after a night out in Soho is easy too.

Similar to options laid out for the Covent Garden Transport options, you also have the option of buses passing through Tottenham Court Road, Oxford Street, Strand, and Leicester Square will also get you close to Soho too.